ValleyNXT Ventures launches the ₹400 Cr Bharat Breakthrough Fund-I to bridge the "Valley of Death" for early-stage Deep Tech and AI startups in India.

Sseema Giill

Sseema Giill

NEW DELHI ValleyNXT Ventures has announced the launch of its maiden scheme, the Bharat Breakthrough Fund–I, a SEBI-registered Category I Venture Capital Fund with a target corpus of ₹400 crore. The fund is designed to support early-stage startups in the deep-tech and tech-first sectors, specifically addressing the critical growth phase known as the "Valley of Death."

The fund was officially unveiled in New Delhi on February 14, 2026, comprising a base corpus of ₹200 crore and a greenshoe option of an additional ₹200 crore.

The primary objective of the Bharat Breakthrough Fund–I is to provide capital and strategic guidance to startups transitioning from the seed stage to Pre-Series A. This period, often termed the "Valley of Death," is where many promising ventures fail due to a lack of execution clarity and fragmented advice, rather than just a lack of funds.

To mitigate these risks, ValleyNXT Ventures is deploying a unique "VC + Accelerator" model. This approach utilizes their proprietary MIB Framework (Mentorship, Investment, and Business Connects), which aims to combine financial backing with hands-on operational support.

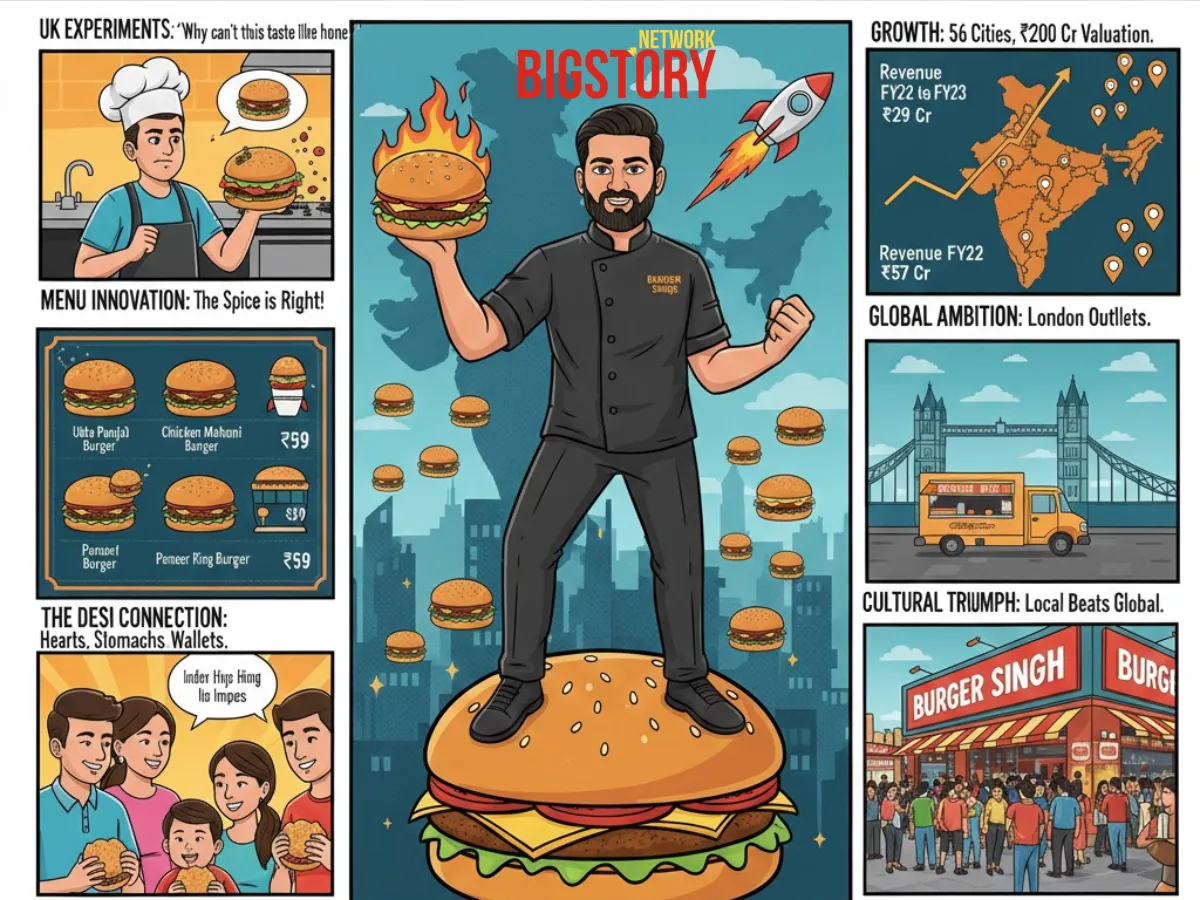

The fund will focus its investments on high-impact sectors including SpaceTech, Defence Tech, Robotics, AI/ML, Cybersecurity, BioTech, Sustainability, and Consumer Innovation.

Speaking at the launch, Dr. Nikhil Agarwal, Founder & Advisor at ValleyNXT, emphasized the fund's philosophy. "Venture alpha is most concentrated at the seed and pre-Series A stage, when companies are still highly shapeable," Dr. Agarwal stated. He noted that structured guidance during this phase can significantly compound outcomes for investors and founders alike.

The leadership team for the fund includes seasoned industry experts Dr. Madhu Vasepalli (Founder & Managing Partner), CA. Anand Saklecha (Founder & Head of Investment Committee).

During the launch event, panel discussions centered on the challenges of early-stage scaling. Speakers, including Nipun Agarwal and Ish Babbar, highlighted the necessity of "disciplined execution" before capital deployment. The fund’s managers argued that the "Valley of Death" is fundamentally a directional problem, which the fund intends to solve by offering startups access to a strong angel network and accelerator-driven ecosystem.

ValleyNXT Ventures enters the market with a track record of evaluating over 5,000 deals and investing in more than 10 ventures through its existing network. The new fund aims to institutionalize this approach, offering a lifeline to founders building India’s next generation of critical technologies.

Sign up for the Daily newsletter to get your biggest stories, handpicked for you each day.

Trending Now! in last 24hrs

Trending Now! in last 24hrs